A new era for FinTech?

The unfolding COVID-19 crisis is having a tremendous effect on the global economy, with a disproportionate impact on small and medium sized businesses. Within this sector, FinTech has not been spared and many firms are now being tested on the resilience of their business models. The current global situation will prove to be the starting point of a new era for the FinTech sector and leading to a new paradigm in the long-term.

Here we introduce the first of a two part series examining how FinTech companies can maintain their success through value creation for the industry in distress, its consumers, and investors. It follows a common theme: the merging of different themes to create growth, and ultimately change.

A new market in decline

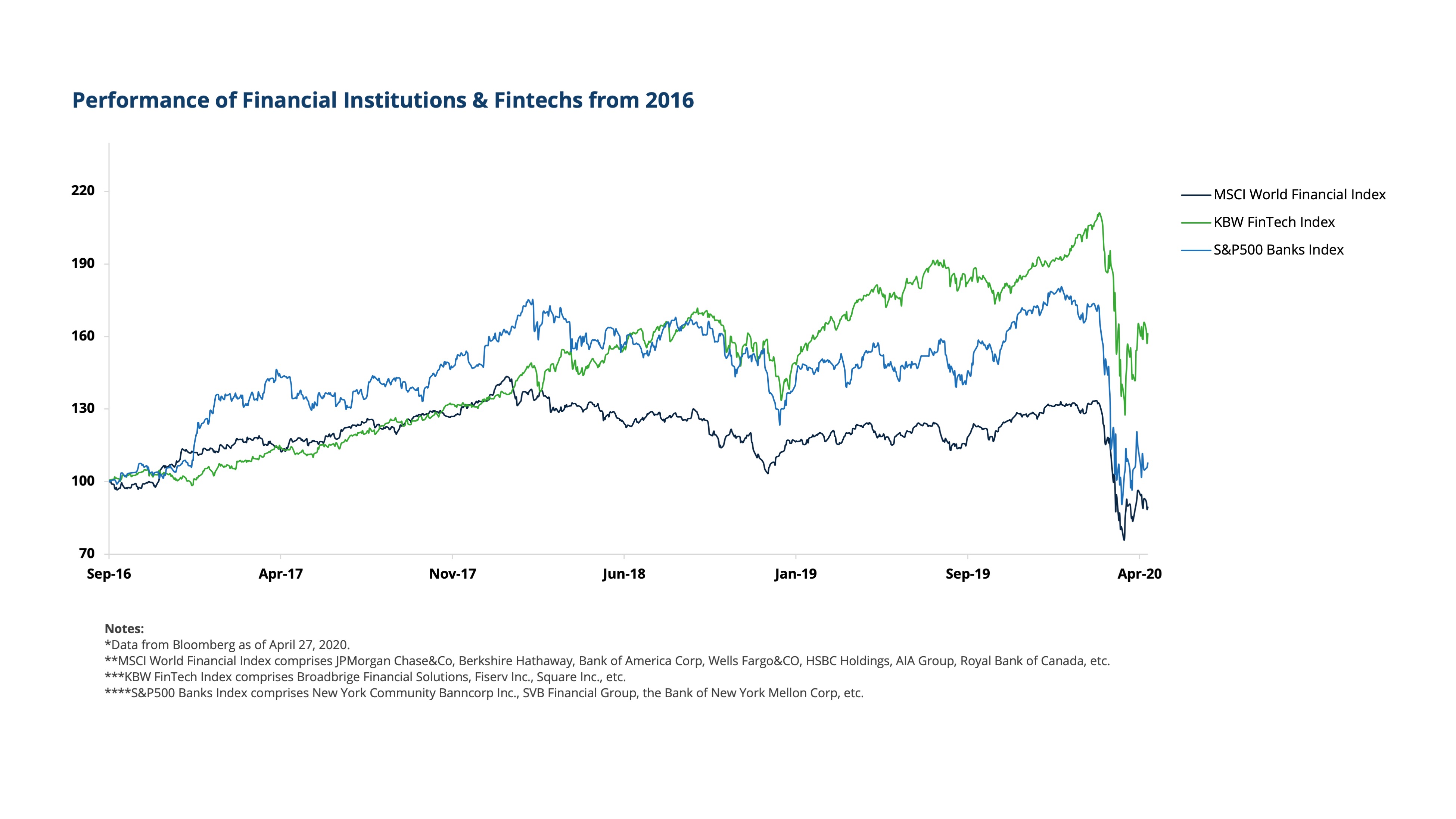

First signs of the impact of the current pandemic on the Global economy was seen in equities markets, which dropped to their lowest point since 2016, retracting their 4-years gains. FinTech companies have been significantly affected, especially in comparison to other benchmarks comprised of incumbents on the market (e.g., KBW FinTech Index, MSCI Financial World, and S&P 500 Banks Index).

Usually, the private market follows these benchmarks, and we should see an impact on venture capital and/or private equity-backed FinTech businesses in the months to come, with some impacts already being widely felt as you read this (e.g. startup layoff tracker here).

At this time, we expect traditional financial institutions to be less vulnerable in the current environment than their digital-only counterparts due to their brand, well-capitalized position, and pool of clients; even though FinTech companies have largely reimagined how we interact with traditional finance systems since 2008.

FinTech – a Phoenix Emerging from the Ashes

Trust is one of the fundamental pillars of the financial industry. There is no secret recipe to create trust between a business and its customers, but transparency, accountability, creation of value and end-to-end support are often the roots of one’s trustworthiness.

Since 2008, FinTech companies brought products and services as an answer to a world shaken at its core by the demise of brick-and-mortar companies entrusted to fundamentally manage one of customers most precious asset: wealth.

These disruptors managed to leverage technology to provide better products, customer experience and transparency, sweeping the general post 2008 crisis fear towards financial incumbents.

In an industry where trust is paramount, the question is whether this digital-only model will pay off in the long-term, in a time where users are being forced to change behavior amidst wider economic ramifications.

Guillaume Chabot – Io Enterprises

While the current crisis challenges the resilience of FinTech, some of them will grow with a stronger value proposition that will lead to incremental changes in the future.

Innovation in times of crisis can become a foundation for the years ahead. The sector will thrive against this backdrop, with FinTechs emerging like a phoenix from the ashes, reframed by their experience in navigating through these difficult times. But how?

Nearly Coming Full Circle

I believe the COVID-19 crisis has triggered a change in customers’ behavior at a time where FinTech is becoming mainstream, and fiercely competitive. Being digital-only will not be sufficient to create new leaders in the long-run; even though, current trends could suggest a general consensus to rushing into digitization.

“Only a crisis, actual or perceived, produces real change” (Milton Friedman)

FinTech leaders of tomorrow must develop trust with a business model merging the best of digital-only FinTechs (“disruptors”) and the best of the brick-and-mortar financial institutions (“physical incumbents”) to create a more complete and satisfying customer experience. While this is not quite coming full circle, from digital back to physical, we are perhaps going to see a blend of the two, that some experts have coined, “Phygital” (physical and digital).

Let me explain from my perspective how this has happened and what this practically means.

Pre-Crisis: A Frenzy to go Digital

Many FinTechs that we know today emerged from the 2008 crisis, including Revolut and Monzo. Their mission has been to redefine physical incumbents’ (e.g. highstreet banks) business models to provide more efficient and improved customer experience.

The emergence of these disruptors was led by the arrival of new mobile devices. Unsurprisingly, the client pool that adopted these financial technologies were tech savvy and living in urban areas, often referred to as Millennials and Generation Z. As the competition increased, disruptors chased these consumers by spending part of their capital on marketing in order to scale their customer base. They relied on investors’ capital to finance this activity, and gain market share.

During this time the FinTech industry became more competitive and the cost of acquiring new customers became increasingly expensive in an industry known for customer inertia.

Post-Crisis: A Change in Customer Behavior

In comparison with the 2008 global financial crisis, where consumers were compelled by the impact of the crisis on traditional methods of finance to try out new digital alternatives, my view is that the current crisis make customers shift more towards traditional financial institutions as they adopt a more risk-averse attitude around the pandemic.

Trust is vitally important here. FinTechs who are unable to provide this to consumers will face unprecedented churn and loss of customers to the incumbents, who are often perceived as bulwarks during times of crisis.

Importantly, for already established customer segments, such as the “mom and pops” segment who are often more set in their ways – even a crisis like this could fail to persuade them to become new adopters of these solutions, after the crisis.

Therefore, personal interaction is deeply valued by customers, especially in turbulent times where the need for responsiveness, communication and speed is critical.

This crisis is an opportunity for FinTech to shift its digital-only approach towards a balanced strategy with more versatility to better match customer needs.

Such a strategy could increase the clients’ acquisition pool, and/or strengthen the robustness of one’s business model to mitigate the impact of future downturns.

An Evolving FinTech Strategy

Marrying the best aspects of both digital and physical environment will provide an more immersive customer experience and deliver the trust that consumers need. It has worked in sectors such as eCommerce and retail, and it can also work in FinTech.

With customer behavior evolving, as well as the need to create personal lasting relationships, this “phygital” strategy represents a viable approach for FinTech companies to develop trustworthiness and apply this to a broader range of customer segments through a non-intrusive omni-presence in the customer’s life.

This model will strengthen the connection between a consumer and the FinTech company, providing: immediacy, immersion and interaction, with technology as a facilitator to ensure success (source here).

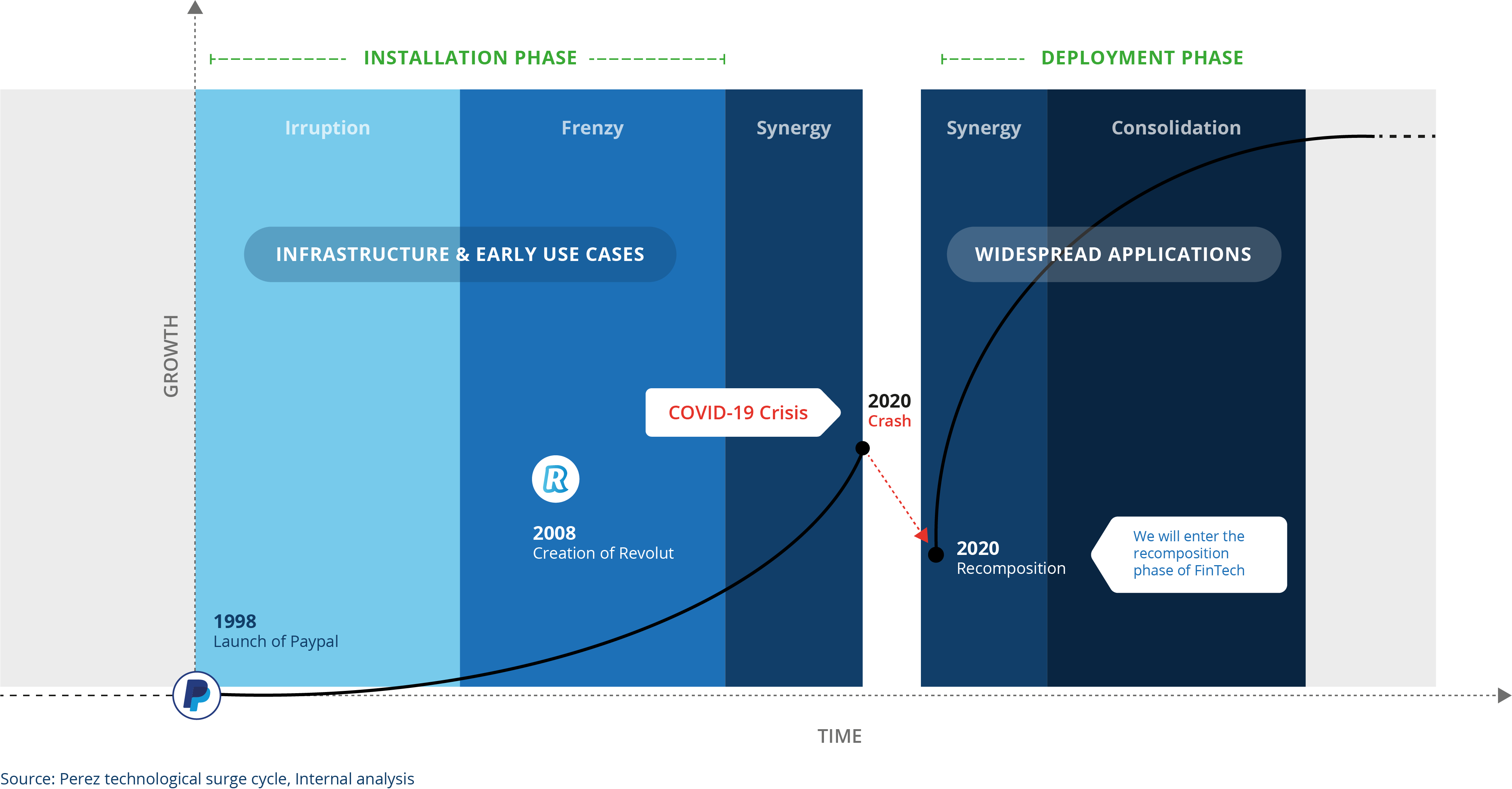

Applying Perez technological surge framework to FinTech

The saying “never let a good crisis go to waste” is a common but highly pertinent phrase right now. If we look at the current state of the technological surge of FinTech, we will surely expect a re composition phase (as seen above). For an industry like FinTech that is constantly looking for synergies, the current crisis has no doubt made this search more complicated. It has driven both incumbents and disruptors to fiercely search for strategic collaboration opportunities and interoperability. As the dust settles, the landscape will look very different.

A successful recovery requires a radical shift in business model, and a blended approach we could see through a mix of digital and physical, or phygital, will be a new direction that FinTech can take as it adapts to survive this crisis.

Written by Guillaume Chabot

Io Enterprises