Covid-19: The impact on Real Estate Capital Markets

As local economies across the world continue to respond to the Covid-19 pandemic through remote working and self-isolation, real estate investors and fund managers have continued to wade through a sea of opportunities and downfalls.

Here we discuss some of those core themes, providing an overview of what’s happened, what’s happening, and what’s expected to come.

The story so far

Since its initial outbreak in late December, what seemed to be a localised virus in the region of Wuhan has grown into a worldwide pandemic. As it continues to spread, there are huge ramifications to the global economy, but more specifically, real estate capital markets.

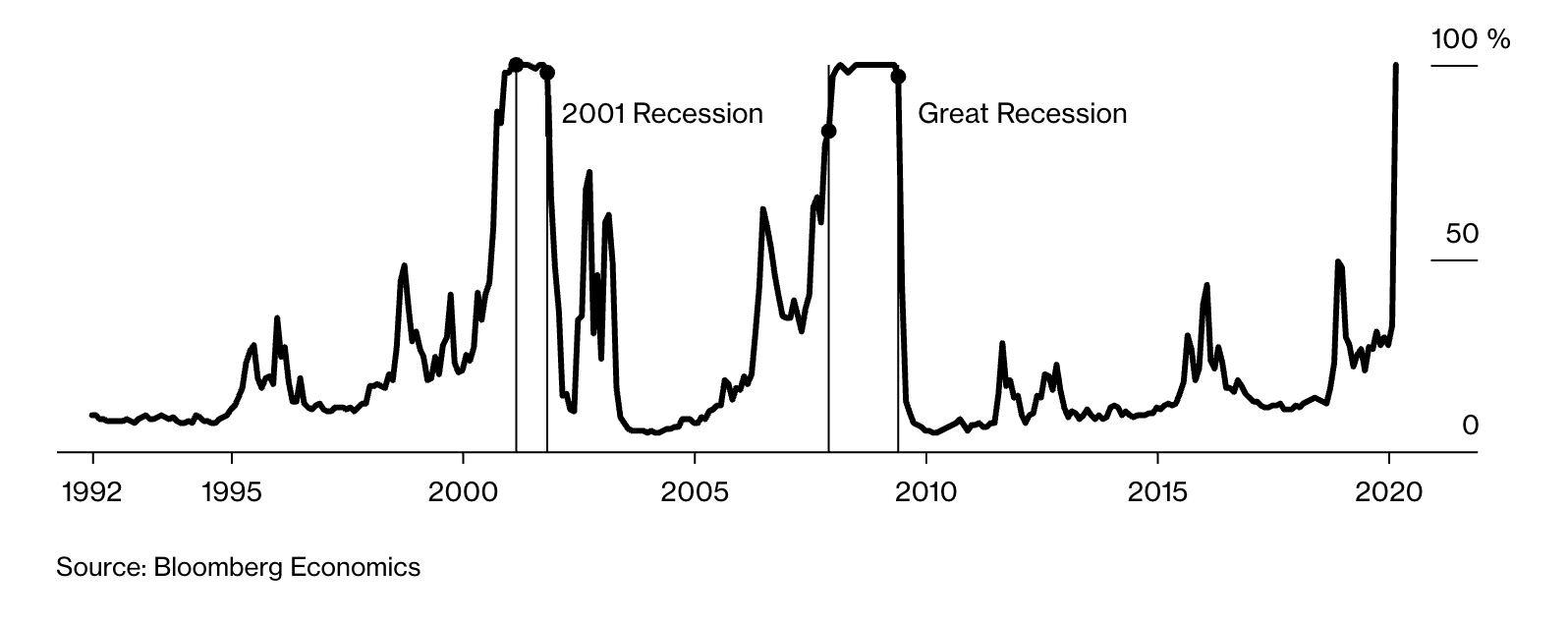

The six weeks of frenetic trading has resulted in some markets experiencing their quickest transitions into a bear market to date, bringing an abrupt end to an 11-year bull market. As governments announce trillion-dollar stimulus packages and central banks respond with rate cuts, several institutions still warn that the default rate for lower quality junk-related issues may still exceed that of 2008.

In Commodities markets, we’ve seen an unprecedented price collapse in the WTI and Brent oil benchmarks, and a crash in emerging market currencies as companies seek to hoard safer denominated currencies.

While it may seem that we’ve approached the bottom of a bear market in recent days, we may now be experiencing a bear market rally that stems from several central banks’ mentality of an ‘all-in’ approach to stimulus.

A reminder of the past

Despite a lot of the themes we see today providing perhaps a reminder of 2008, the recovery and appropriate responses will have drastic consequences within real estate capital markets, especially as further deaths are recorded and Q1 results are released.

Pre-Covid-19, publicly traded and non-listed equity and mortgage Real Estate Investment Trusts (REITs) hit record highs, with the momentous growth underpinned by strong market fundamentals. While strong recoveries have been made over the last decade since the previous crash, the demand shocks have arisen as a result of very different reasons.

In an effort to reduce the transmission of Covid-19, REITs have reduced the day-to-day operations of assets under management by temporarily shutting down hotels, shopping malls, and other hospitality-related properties – in turn having detrimental impacts on their cash flows, and moreover, their stock price and dividends yields.

In spite of the $2.2 trillion stimulus bill passed by Congress in March, the US is poised by market illiquidity

While we see imminent short-term implications directly arising from the lack of economic activity, longer-term consequences relating to poor tenant covenant may result in asset owners facing prolonged vacancies, despite longer-term lease agreements.

In spite of the $2.2 trillion stimulus bill passed by Congress in March, the US is poised by market illiquidity, where cash-strapped mortgage REITs are under pressure, as banks begin making margin calls.

Several large REITs have sought to raise further cash through Private Investment in Public Equity (PIPE) transactions, as they try to refrain from selling assets at steep discounts. In other areas, investors have been purchasing debt and equity at fire-sale prices as portfolios have begun selling marked-down loan portfolios to raise additional cash.

In other areas of the globe, the 249 REITs trading across Asia-pacific exchanges have lost over £82bn from their market values, with an average decline of 25%.

Europe has also experienced substantial deteriorations in real estate capital markets, where some REITs have been trading at a major discount to NAVs.

Where we are today

“Businesses that are largely relationship and/or experience-driven will continue to thrive and provide good tenant coverage for asset owners ”

– Gregor Welton

The market is currently in a state of flux, with some practitioners believing it has reached an inflection point. According to the FTSE Nareit All Equity REITs Index, yields had climbed by 4.75% as of March 31. Nareit has commented that among the highest-yielding equity REIT sectors were Regional Malls at 16.30%, Specialty at 9.92% and Shopping Centres with a 9.63% yield.

While it may seem obvious, REIT performance deviations during the pandemic are expected to arise due to several key reasons; Core Sector Focus, REIT Geography, and Lease & Leverage Structures at the asset level.

Depending on sector exposure, REITs have exhibited different discounts to NAVs arising out of the Covid-19 pandemic. The supermarket focused AIC UK Commercial Property REIT was trading at a 23.4% discount to NAV, whereas other UK-based REITs such as the AEW UK Long Lease (AEWL) is trading at a 48.8% discount to NAV.

Businesses that are largely relationship and/or experience-driven will continue to thrive and provide good tenant coverage for asset owners (this will become more prevalent as countries exit their lockdown).

However, for retail outlets where items sold have slowly become commoditised and available on the web, asset owners will continue to experience the pre-crisis trend where demand will continue to decline.

However, for retail outlets where items sold have slowly become commoditised and available on the web, asset owners will continue to experience the pre-crisis trend where demand will continue to decline.

While pre-crisis senior housing and care homes proved to be asset class with growing interest, the severity of the pandemic may largely impact the future demand for the sector, especially as deaths continue to rise in the vulnerable and elderly categories, although this is expected to tail-off.

REITs with a focus on the hospitality industry, including those with casinos and hotel assets in their portfolios can again expect to feel the full force of the pandemic, and the incoming recession. Given the sharp decline expected, with fixed operational costs and lower revenues, EBITDA will decline by nearly 75%, according to Fitch Ratings.

Again, the uptick and pace of economic recovery for hospitality REITs will largely be determined by international travel policies, with a hopeful and stable outlook for Q2 2021.

While sector exposure poses an obvious reason as to why deviations in REIT returns arise, investors should also factor in macroeconomic fundamentals and geographical differences.

As an example, Singaporean-based REITs (S-REITs) have likely passed their darkest hours as they experienced a peak to trough drop of 40% this year, with further rebounds in recent days. However, given that the city-state is a small nation, its ability to rebound will largely be a testament to the rest of the world’s potential for recovery.

In other parts of the world, we believe Switzerland will remain a region for prosperous investment owing to its strong real GDP growth, low unemployment rate, low public-to-debt ratio, and slump in construction in recent years.

Finally, negative cash flows will become more evident in the coming weeks, where REITs that have significant cash holdings and lower levels of leverage are expected to fare considerably better in the pandemic than those with greater leverage and less cash.

REITs with loan maturities approaching in the coming weeks, may find that refinancing will occur at a higher rate as the banks’ willingness to lend continues to diminish. While illiquidity remains a core topic in markets, investors should further place caution on available funds as some REITs may potentially begin to breach their covenants as they fail to meet their minimum financial ratios.

What’s to come?

While the future is uncertain as ever, many have looked to the 2002/04 SARS outbreak as a source for comparison. Despite clear differences between these outbreaks in terms of the number of infections, deaths, and global reach, a valid and substantive comparison can and should be made.

As a point of resilience towards wider market activity, and basis, for example, the iShares Real Estate ETF (1YR) doubled their market size whilst minimising the trough in share price during the SARS outbreak, perhaps providing hope for investors lacking confidence. However, with that being said, retail assets were in a very different position back then.

A recent analysis completed by BofA Securities underpins comments made throughout this update, implying that some REITs appear to be immune to virus-driven downdraft, and may even stand to benefit depending on their asset’s focus.

Crown Castle (CCI), Digital Realty (DLR), and Medical Properties Trust (MPW) possess assets that are likely to either be relatively resilient to the troughs experienced in some markets or are expected to benefit from the crisis due to their weighted exposure to; Data Centres, Self-Storage, Wireless Infrastructure, Health Care focused RE, and/or Grocery anchored Retail Centres.

Confidence lays within REITs that pertain low leverage, prime location properties, and have high credit rating profiles, resulting in an increased likelihood of outperforming their peers in their relevant geographical fields/sector focuses.

With that being said, it would be unjust not to acknowledge that there are signs of a global recession looming, as record surges in unemployment, catering trade deals and sinking consumption continue to be announced.

The pandemic is likely to keep chipping away at the integrity of the economic system, continuing to test government and central bank responses, and in turn, stall real estate capital markets.

While an economic analysis of the pandemic may provide insight into the future of real estate capital markets, practitioners should note the importance of business continuity through the WFH initiatives that have been put in place, a trend that is likely to change the long-term public perception towards a more distributed workforce.

A decisive issue for the future development of asset classes will be further derived from behavioral changes in the aftermath of the crisis.

A decisive issue for the future development of asset classes will be further derived from behavioral changes in the aftermath of the crisis.

As technology has evolved, people’s work and social lives have become ever more interconnected through technology, and we expect this trend to continue, and if anything, be catalysed by the pandemic. While no major changes to office space business models are expected in the short-term, investors should look further into space optimisation modelling, flexible workspaces, and the implications of hot desking, as businesses find comfortable alternatives to in-office workspaces.

What initially seemed to be a localised virus outbreak in China just over 3 months ago has resulted in a sharp shock to the global economy, placing additional strain on credit markets. While this certainly isn’t the last pandemic, practitioners can and should better position themselves long-term, and should look to make the most of the opportunities and signal’s that have risen as a result of the pandemic.

Looking ahead

Today, we are in a very different situation to where we were in 2008: the balance sheets of REITs are in a substantially stronger position, with leverage at historical lows and staggered debt maturities limiting the need to refinance when credit spreads have widened.

While governments and central bankers continue to ramp up their responses, we expect REITs to be tested globally, where their exposure to specific asset classes and currencies may provide closure to their NAVs.

With that being said, we continue to hold a positive outlook on real estate capital markets, where leverage and liquidity strains will largely determine long-term investment viability.

While we remain confident that a strong and steady recovery will follow, investors should not overlook the potential downfalls to come, and should maintain a specific focus on sector, lease structure agreements, global macro outlooks, and financial leverage at the asset level.