The effect of Covid-19 on FinTech: five graphs that matter

FinTech has not been spared from the global pandemic and many firms are now being tested on the resilience of their business models.

The current global situation will prove to be the starting point of a new era for the FinTech sector and will lead to a new paradigm in the long-term.

This article explores five key charts that map the impact of Covid-19 on the FinTech sector. We want to highlight the lessons we can learn from this turbulent time, as well as the opportunities that exist in this dynamic and innovative industry.

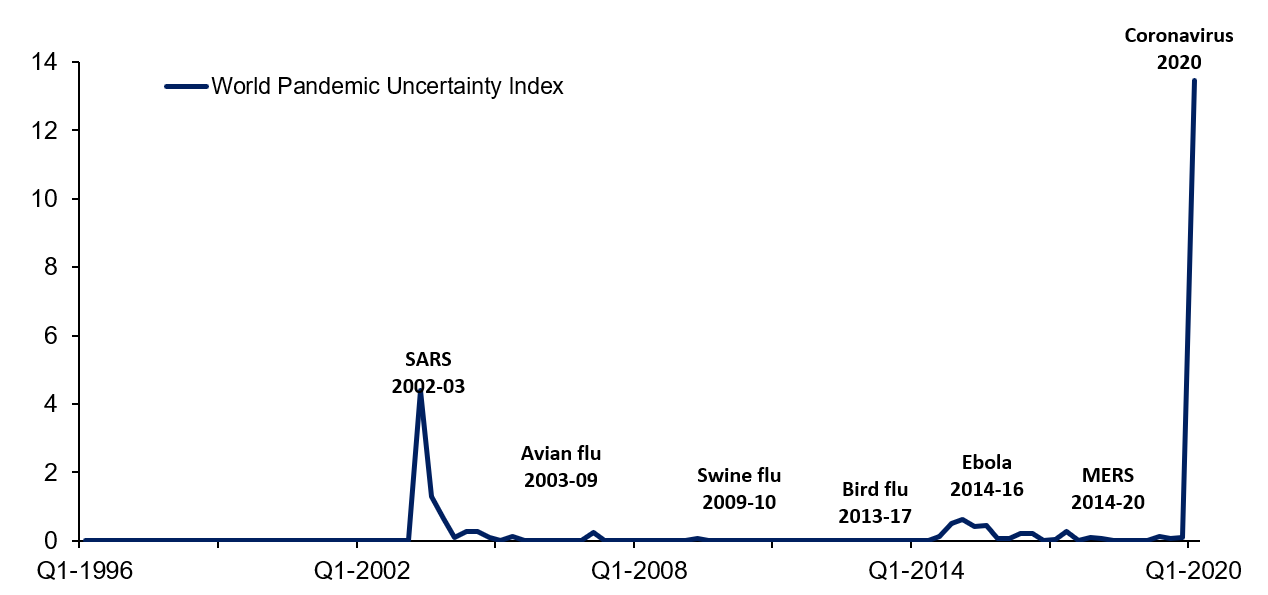

Record uncertainty creates record opportunity

[Source: IMF | World Uncertainty Index]

This graph from the IMF shows the record levels of uncertainty in the first quarter of 2020. Within this there is always a chance for opportunity, and now is the time for financial institutions to shift their approach and bring innovative solutions to the table.

Increased uncertainty will also mean increased collaboration as banks look to diversify and generate revenue from new streams to curb the impact of the crisis on the bottom line.

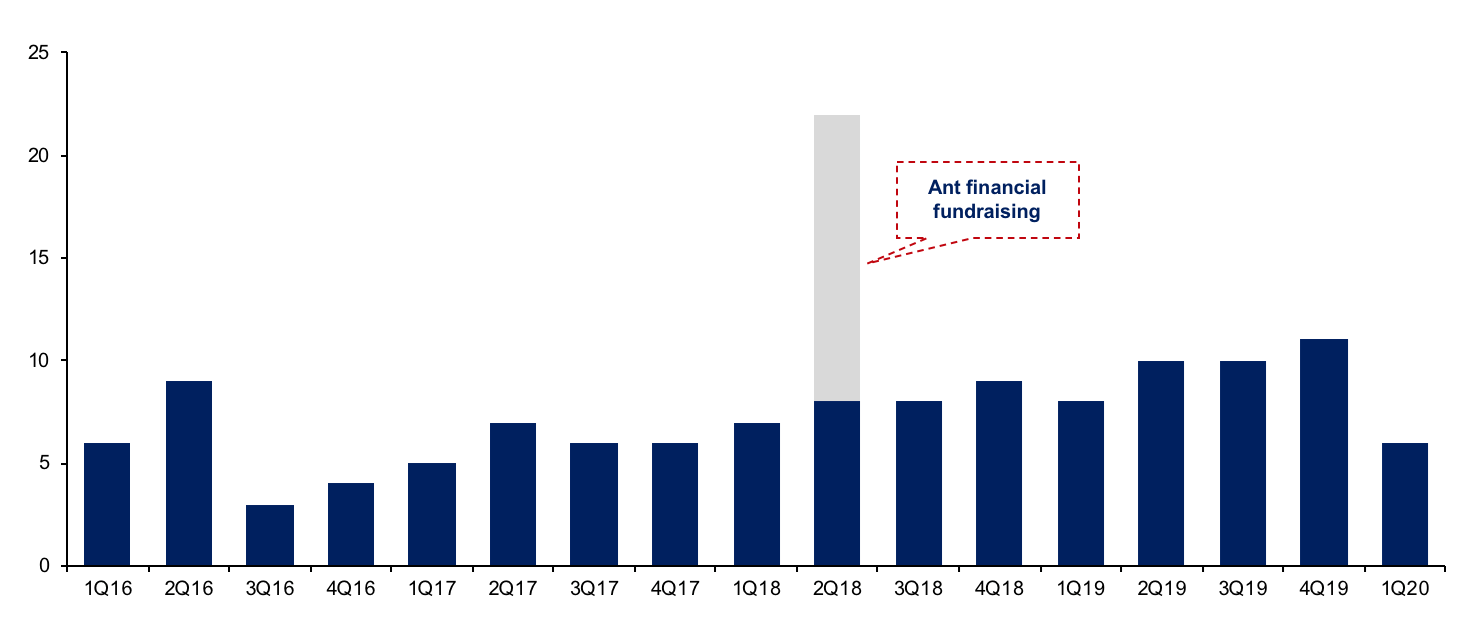

FinTech funding faces a three-year setback

[Source: McKinsey]

The impact of Covid-19 has meant that we’ve seen FinTech funding dropping back to levels previously only seen 3-years ago, plummeting by a staggering 30% during the pandemic. FinTech as a sector will undoubtedly be under stress, presenting an opportunity for incumbents to acquire innovative businesses at a discount.

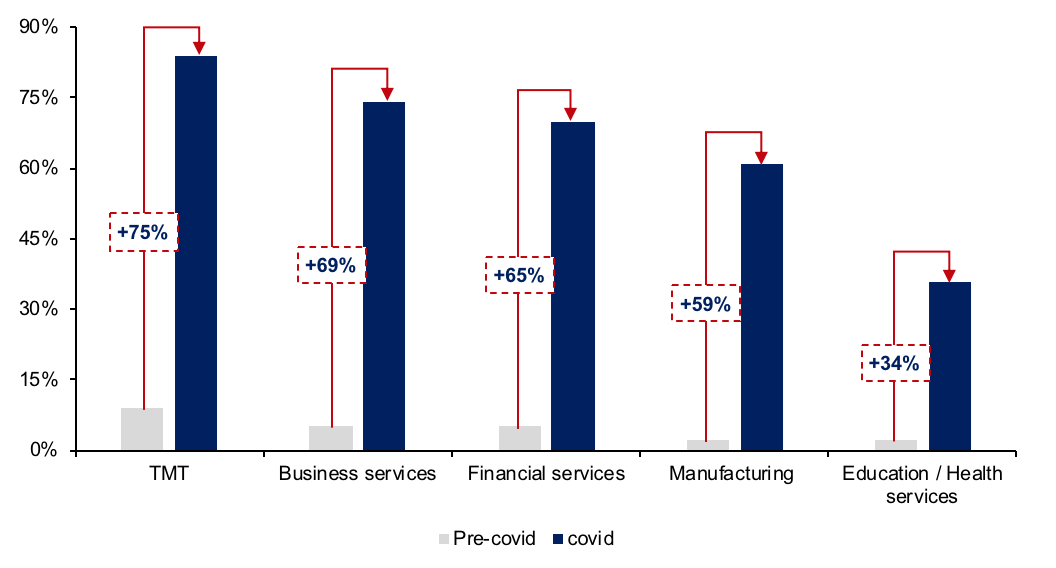

Financial services has been a laggard in adapting to digital services

[Source: McKinsey]

Digitisation has been seen across a range of sectors during the global lockdown, with TMT and business services leading the way. However, with only 65% growth in digitisation in Financial Services, there is still critical work to be done and the sector needs to further adapt to deal with the current crisis. A lack of digitisation significantly hinders development, this is where FinTech can play an important role.

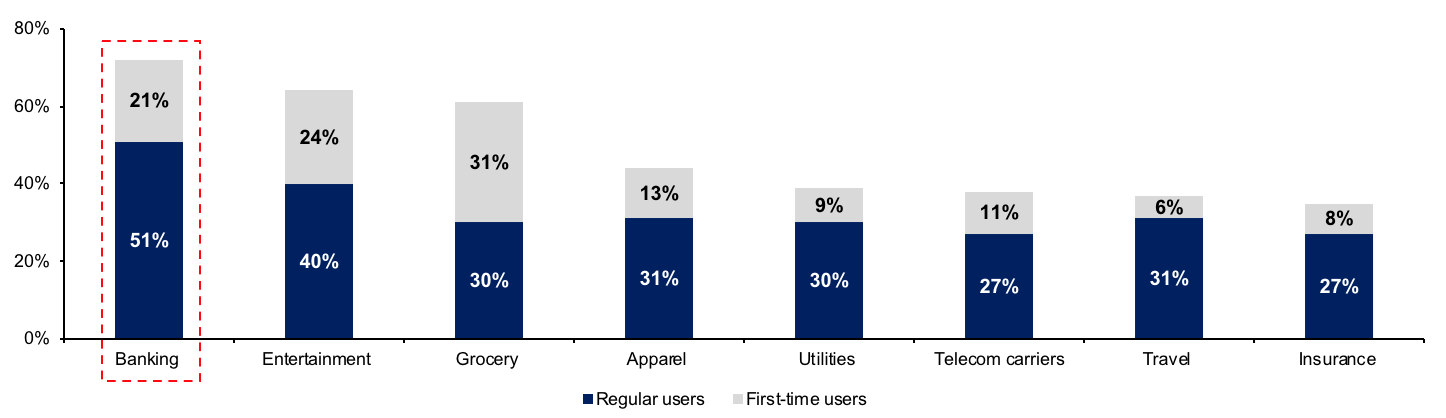

The crisis represents a major tipping point in digital offerings for the banking sector

[Source: McKinsey]

There have been significant changes in consumer behaviour during the Covid-19 crisis. In the banking sector consumers are increasingly demanding a shift to digital services, but institutions are failing to meet this demand.

This demand, combined with the wholesale adoption of technology by consumers means that banking institutions must begin to implement increasingly sophisticated digital services to match their consumer base. The crisis represents a major tipping point in digital offerings for the banking sector.

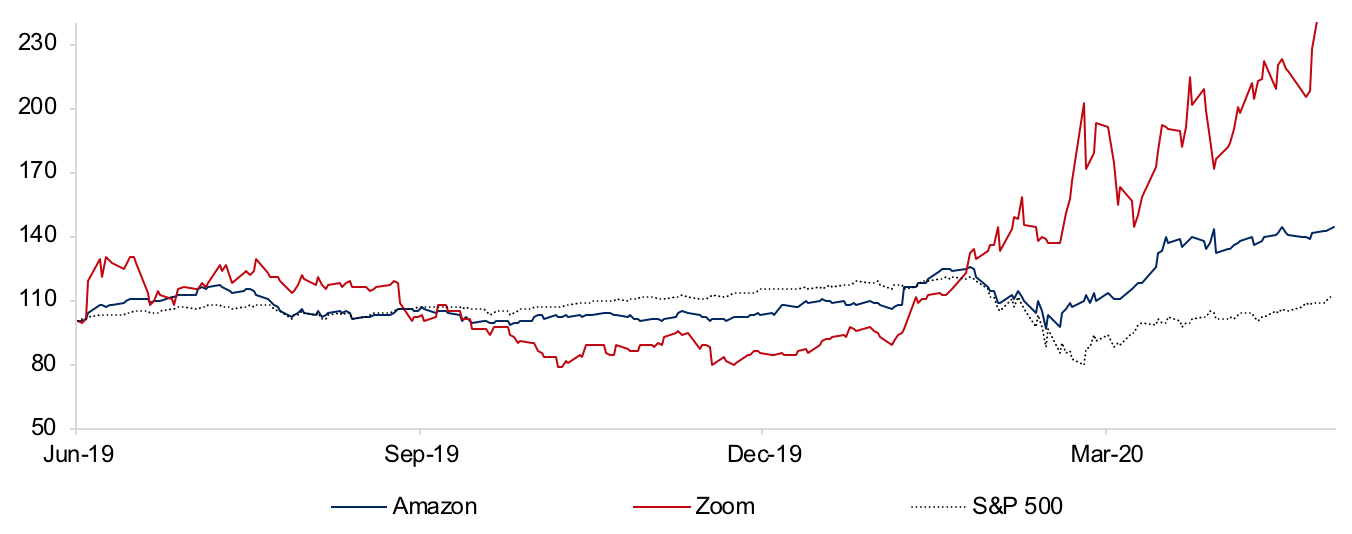

Tech Zoomed ahead of the S&P500 in the midst of the crisis

[Source: Yahoo Finance]

The market story of this year has no doubt been Zoom Video Communications, Inc. As the world shifted to remote working and living, Zoom began a bull run of which we have not seen the end. It is currently up 250% this year, even despite investors mistakenly betting on the wrong company thanks to a ticker confusion with Zoom Technologies, a small Chinese company.

Zoom’s story illustrates the potential that technology has, and how it can quickly integrate itself in our everyday life. It also highlights the way we must change our thinking when it comes to investment.

Written by Adam Battersby

CEO, Io Enterprises