A market in transition: 5 ways FinTech is shaping Germany’s wealth and insurance landscape

The German FinTech market has shown promising signs of potential as we emerge out of lockdown. A dynamic and hugely important economy, Germany has emerged quickly from the Covid-19 crisis and we expect its FinTech ecosystem to bounceback equally as fast.

A critical part of this is the inroads made by technology firms into Germany’s wealth and insurance sector, which have so far undergone massive change through new and exciting technologies being applied to an otherwise traditional industry.

This piece seeks to explore some of the trends we are seeing develop in the German FinTech landscape and how these have impacted the wealth and insurance sectors specifically.

The direction is up for Robo-Advice

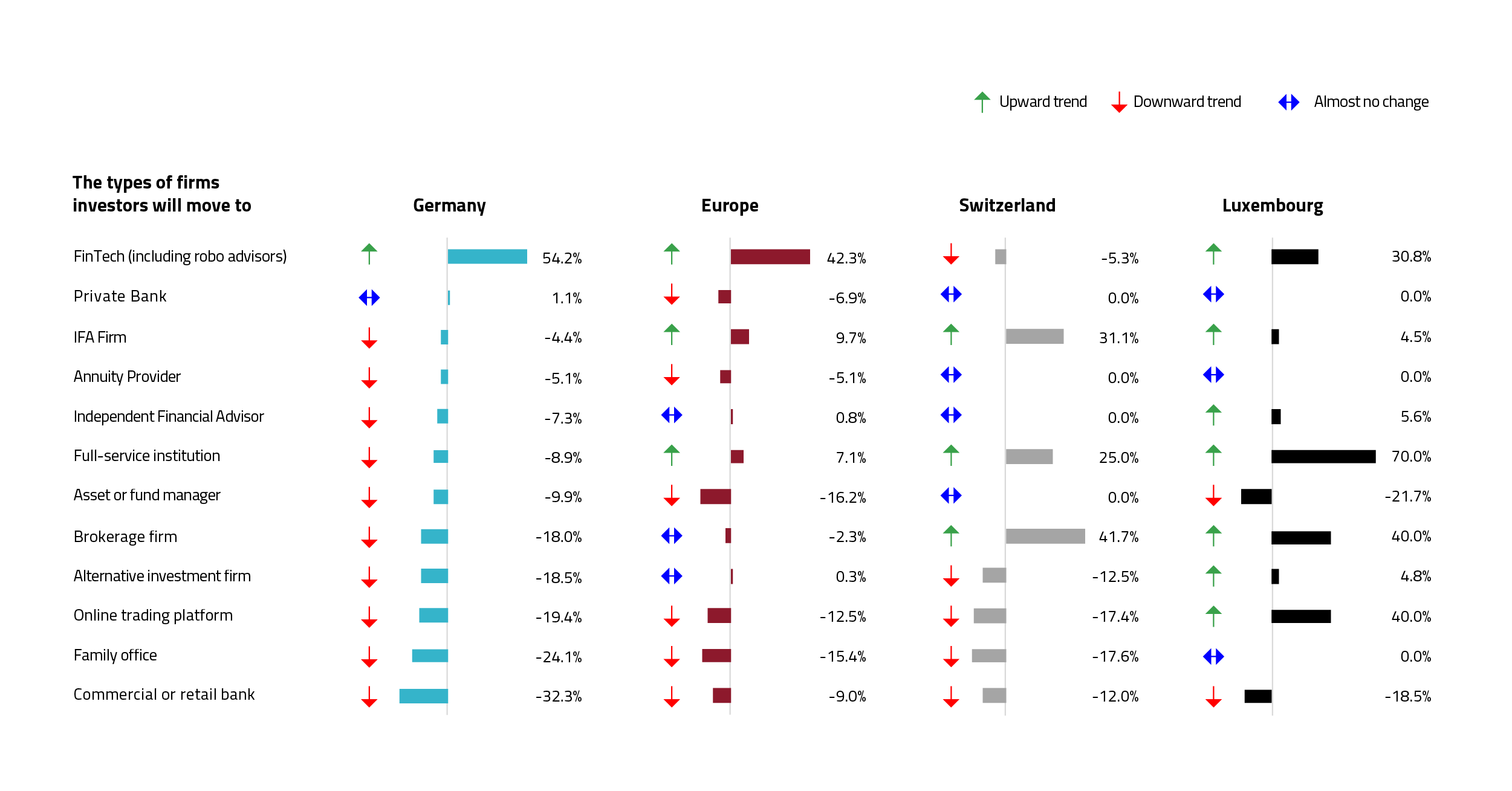

Percentage difference between the proportion of German investors using each type of firm now and those expecting to use that type in three years

Source: EY

We are extremely focused on German FinTech because this market is not only growing faster than its European neighbours, but also faster than the European market as a whole.

German investors are shifting to robo-advice, with this chart highlighting the proportion of investors using each type of investment firm both now, and those expecting to use that type in three years. This dynamic will drive the German FinTech market upwards, and businesses will see a boom higher than the European average. Importantly, WealthTech firms in this market are winning the battle against their incumbents. The German robo-advisory market has a stunningly bright outlook going forward.

Investment in WealthTech continues to increase

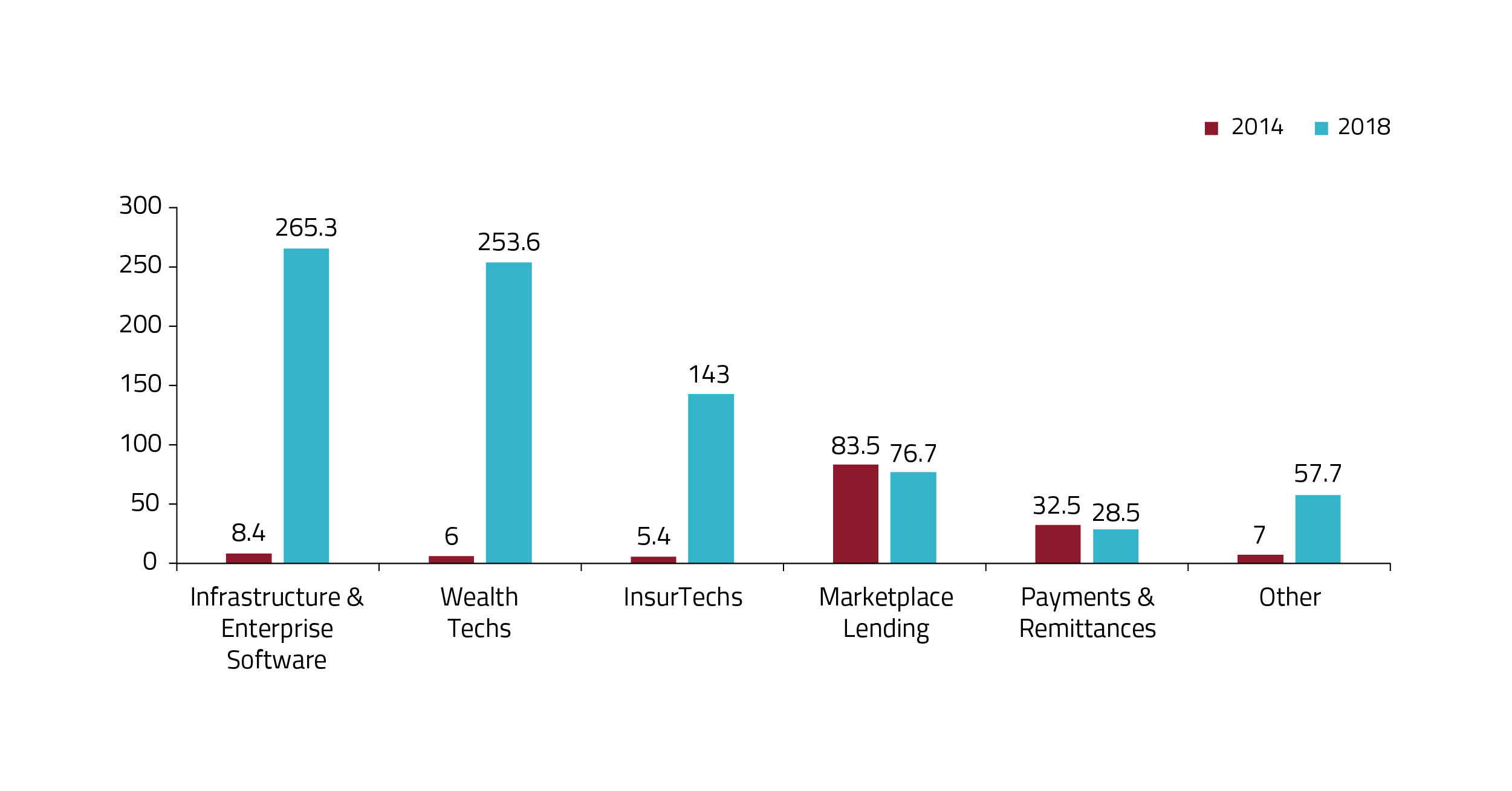

Fintech investment in Germany by subsector, 2014-2018 (USD)

Source: Fintech Global

The amount invested in WealthTech in Germany over the past four years has increased by an incredible 42 times. This is a direct result of the strength and breadth of FinTech innovation in the region and the client-centric solutions that are being delivered across the market.

InsurTech – survival of the fittest

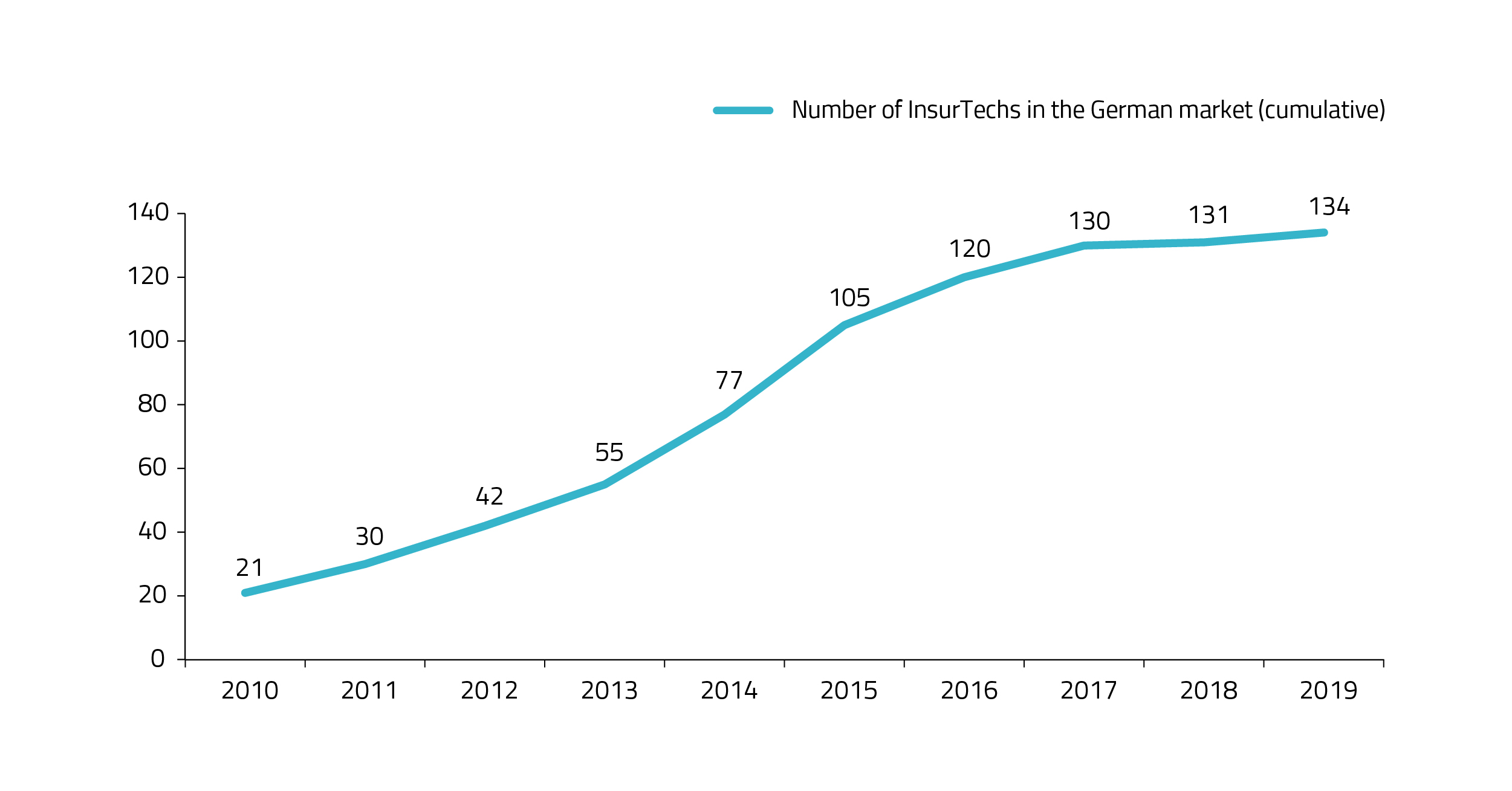

Number of InsurTechs in the German market (cumulative)

Source: Oliver Wyman

While the InsurTech sector has grown steadily in Germany since 2013, we have seen the market flattening over the past 2 years. One of the key problems here has been the crowded environment in this sector.

As a result, many InsurTechs withdrew or have pivoted away due to the intensive competition. We believe that those who stayed showed true resilience in their business and the combination of Physical and Digital acquisition in their models has been the key to their success.

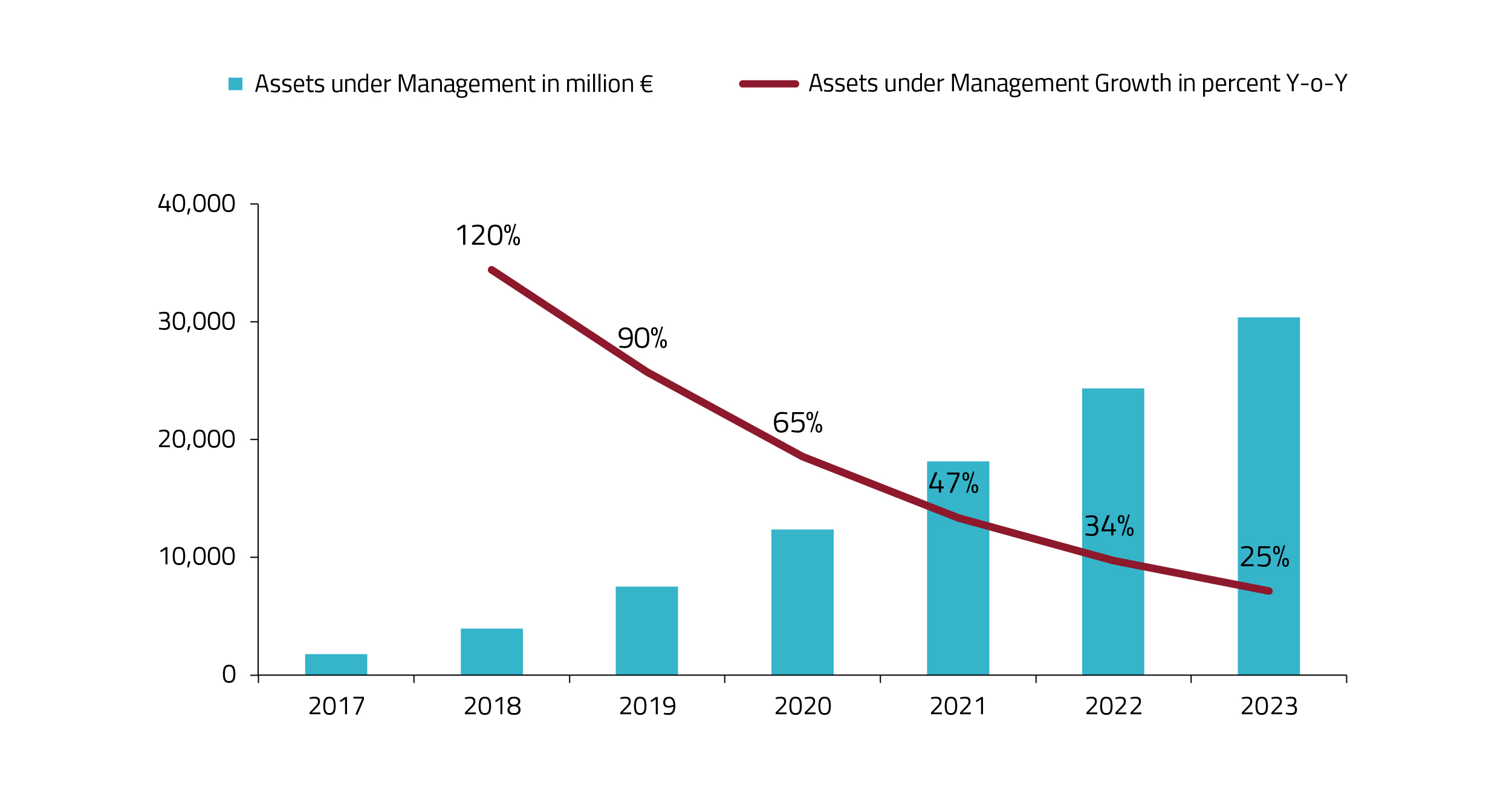

Growth of Robo-Advisor clients to continue, albeit at slower rates

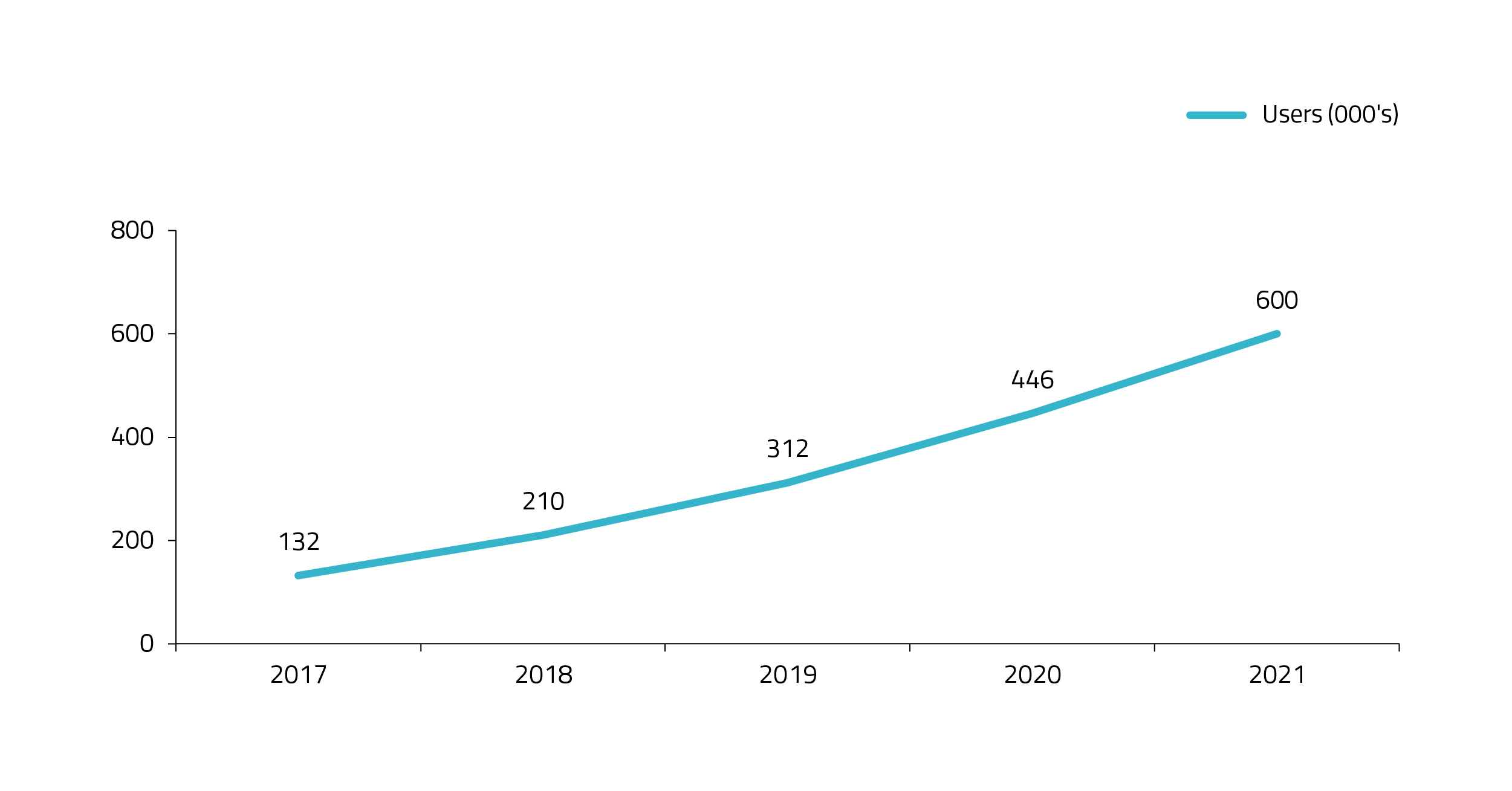

Growth of digital asset and wealth manager from 2017 to 2023 forecast

Source: Statista, EY

As we mentioned above, robo-advisors are making significant inroads in Germany and attracting an increasing number of clients at a spectacular pace. This trend is leading to higher ETF adoption by retail investors, previously subdued by an overreliance on pay-as-you-go pension plans and traditional financial advisory services.

Despite the rapid growth of robo-advisors there is still a large addressable market of potential clients.

Digital assets and wealth managers will earn their users’ trust, thus increasing the AUM growth of platforms.

Source: Statista, EY

The number of clients adopting digital wealth managers is expected to see tremendous growth through to 2023, with more clients entrusting digital FinTechs in managing their assets. The German market is among the leaders in this shift to digital. AUM growth has had an exciting journey in Germany over the last 3 years, a trend that is expected to continue with a Compound Annual Growth Rate (CAGR) of 35% in 2020-2023.